It’s not a controversial statement, but most college students aren’t particularly wealthy. After all, college, like most things, isn’t cheap. Now it can be argued up and down that college should be federally or state funded, but that’s its own beast. This would be a smaller issue if things weren’t so overpriced.

Has anyone noticed that everything around us is competing for the world record of most overpriced goods or services ever? Someone contact Guinness World Records, we need a new plaque, stat. In all seriousness, there are some ridiculous price tags out there right now.

Food prices have skyrocketed, with even fast food being nearly double its price from 2014. A quarter pounder from McDonalds was $5.39 last year. Now, it’s $11.99. Prices fluctuate all the time of course, so it’s not like this is anything new, right?

Tasting Table

Well, yes and no. Inflation happens all the time, in fact capitalist societies are built with it in mind. Though the inflation rate has lowered gradually since record highs in 2022, it’s still quite higher than average. It wouldn’t be as bad if our standard of living and wages were higher, yet that’s not the case.

Minimum wage is still somewhere between $15-25 an hour, depending on where you work. That’s not exactly a livable wage anymore, unless you’re working four different jobs. Not to mention paying for gas, electricity, water, clothes, internet, the air you breathe, your soul, your dignity, and etc.

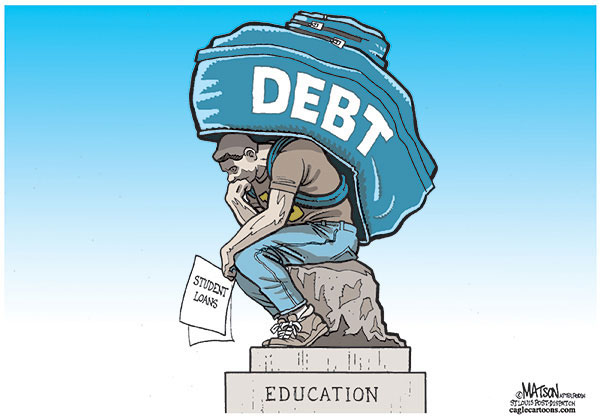

On top of all those things, are college prices. These things snowball. It’s hard to pay off college debt when you’re also paying for a multitude of other important things that many can’t live without. Education is incredibly important, especially when misinformation is at an all time high thanks to AI.

Now college debt isn’t the harshest debt out there, and it’s often quite forgiving. However, it can be daunting and is frustrating to think about on occasion. Is buying this video game you’ve been wanting to play for a year worth it? How will this affect students’ ability to pay off their debt?

The cost of living needs to be brought down, otherwise people will continue to suffer and sacrifice important things in their life for the sake of survival. The average college student will pay off their debt in ten to twenty years. The money that takes out of the wallet could be going to gas or food, instead it’s going to some loan agency with more money than they need.

Change takes time unfortunately, so in the meantime, little things will have to be done. Cutting down on fast food and being mindful of what you buy are good first steps. Fast food isn’t really that fast anymore, and the taste just doesn’t justify the price either, so why bother buying it? If you can’t think of a good reason by your criteria, you have your answer.